Defending Against COVID-19 Cyber Scams

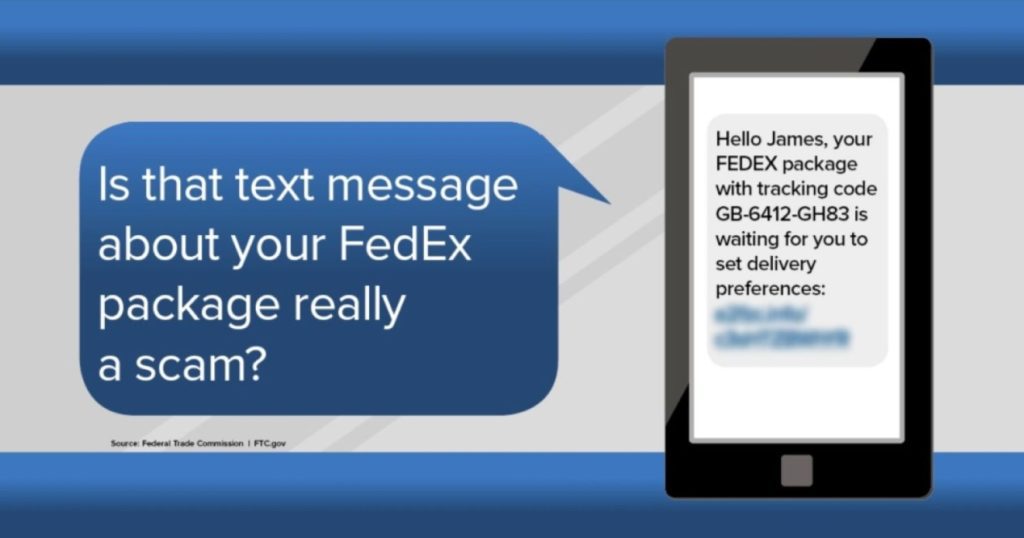

The Cybersecurity and Infrastructure Security Agency (CISA) warns individuals to remain vigilant for scams related to Coronavirus Disease 2019 (COVID-19). Cyber actors may send emails with malicious attachments or links to fraudulent websites to trick victims into revealing sensitive information or donating to fraudulent charities or causes. Exercise caution in handling any email with a COVID-19-related subject line, attachment, or hyperlink, and be wary of social media pleas, texts, or calls related to COVID-19.

CISA encourages individuals to remain vigilant and take the following precautions.

- Avoid clicking on links in unsolicited emails and be wary of email attachments. See below for websites with helpful resources (simply copy and paste URL into internet browser – no need to add “www.”):

- Using Caution with Email Attachments:

us-cert.gov/ncas/tips/ST04-010 - Avoiding Social Engineering and Phishing Scams:

us-cert.gov/ncas/tips/ST04-014

- Using Caution with Email Attachments:

- Use trusted sources—such as legitimate, government websites — for up-to-date, fact-based information about COVID-19:

cisa.gov/coronavirus - Do not reveal personal or financial information in email, and do not respond to email solicitations for this information.

- Verify a charity’s authenticity before making donations. Review the Federal Trade Commission’s page on Charity Scams for more information:

consumer.ftc.gov/articles/0074-giving-charity - Review CISA Insights on Risk Management for COVID-19 for more information:

cisa.gov/sites/default/files/publications/20_0306_cisa_insights_risk_management_for_novel_coronavirus.pdf