Now you can start making catch-up contributions! You can contribute an additional $6,500 over the $19,500 base contribution to a qualified employer-sponsored retirement plan or an additional $1,000 over the $6,000 base contribution to your IRA.

Save now to enjoy later.

Schedule an Appointment

Whether it’s traveling across the country or across an ocean, or simply spending some time in your garden or workshop, planning for retirement means finding a way to put money away, watch it accumulate, and shelter it from taxes. Liberty Bank’s selection of Individual Retirement Accounts (IRAs) and other investment options let you choose a path that’s right for you.

An IRA is an investment account that is designed to help you save for retirement. IRA earnings are tax-deferred until you make retirement withdrawals, so all of your money will continue working for you, year after year. You may even qualify to reduce your current taxable income by deducting your IRA contributions.

You don’t have to go to a big bank to open an IRA. We can help you determine which IRA is right for your financial situation and discuss the benefits of opening a retirement savings account or CD at Liberty Bank.

These two types of Individual Retirement Accounts are both available at Liberty Bank.

Roth IRA accounts are available to all individuals with earned income, regardless of age.

Contributions are made with after-tax money, so you won’t pay any tax when you make a future withdrawal from your retirement savings account (assuming you meet certain additional requirements.)

Traditional IRA accounts are also available to all individuals with earned income, regardless of age.

However, as an individual pre-tax savings account, contributions are tax-deferred. That means you pay tax when you make withdrawals.

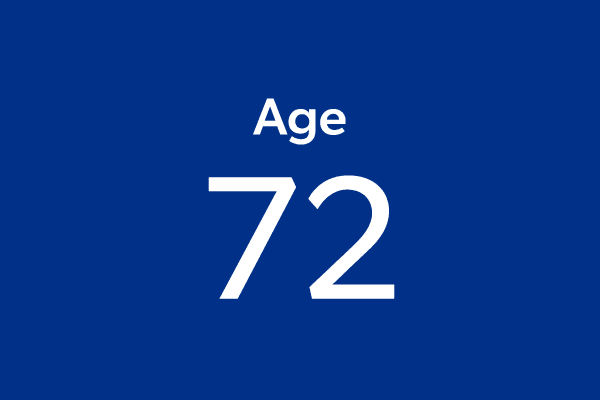

Now you can start making catch-up contributions! You can contribute an additional $6,500 over the $19,500 base contribution to a qualified employer-sponsored retirement plan or an additional $1,000 over the $6,000 base contribution to your IRA.

No longer working? You may be able to start withdrawing from your 401(k) penalty-free.

Whether you’re working or not, you can start withdrawing money from your 401(k) or IRA.

You can start claiming Social Security benefits – but consider carefully, as most people will be able to claim more money if they wait a few more years.

You now qualify for Medicare! Sign up three months before your turn 65 for the lowest premiums.

Full retirement age depends on the year you were born. If you were born before 1955, you qualify for full retirement age at 66. Born after 1959? Your full retirement age is 67. If you were born between 1955 and 1959, your retirement age is somewhere in between 66 and 67.

Your Social Security benefits max out at 132% of the full initial benefit! If you haven’t started claiming benefits yet, now is the time.

If you haven’t yet taken any distributions from your IRA or employer-sponsored retirement accounts, now is the time. You will need to take your first Required Minimum Distribution (RMD) this year.

When you change jobs or get closer to retirement age, your best option is usually to roll over your 401(k) into an IRA. However, if you don’t have a high account balance, it can be hard to find professional advice. At Liberty Bank, we offer multiple FDIC-insured IRA options for rollovers with minimum balances of just $500.

No matter the size of your retirement account, Liberty Bank professionals are available to discuss your goals, provide you with options, and assist with the paperwork involved in moving your old workplace retirement account to an IRA.

There are several types of IRAs available; here at Liberty Bank, we offer an IRA Certificate of Deposit (CD) that gives you the tax advantages of an IRA with the security and guaranteed returns of an FDIC-insured CD, with some of the best IRA CD rates in Chicago. And of course, we never charge for record-keeping or reporting your Liberty IRA.

To learn more, give us a call at 773.384.2030 or stop in.

On December 20, 2019, the U.S. Congress passed the Setting Every Community Up for Retirement Enhancement Act, otherwise knows as the SECURE Act. The Act includes reforms that could make savings and retirement more accessible.

Liberty also offers retirement options for small business owners and the self-employed. Learn more about the advantages of a SEP IRA (Simplified Employee Pension) here.